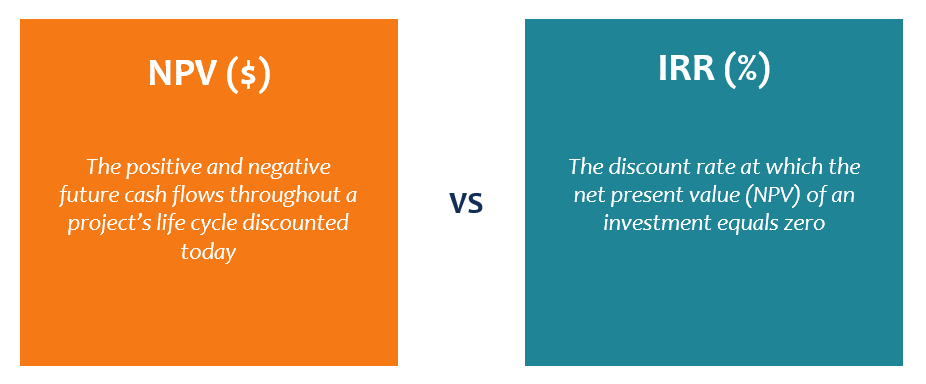

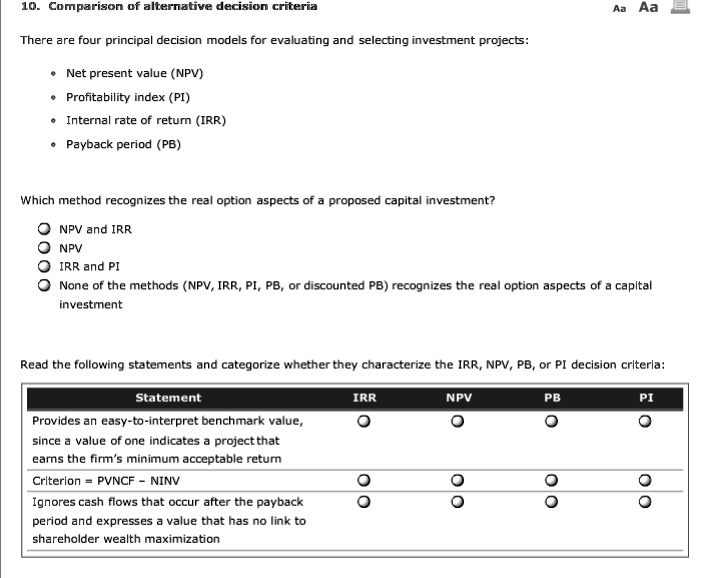

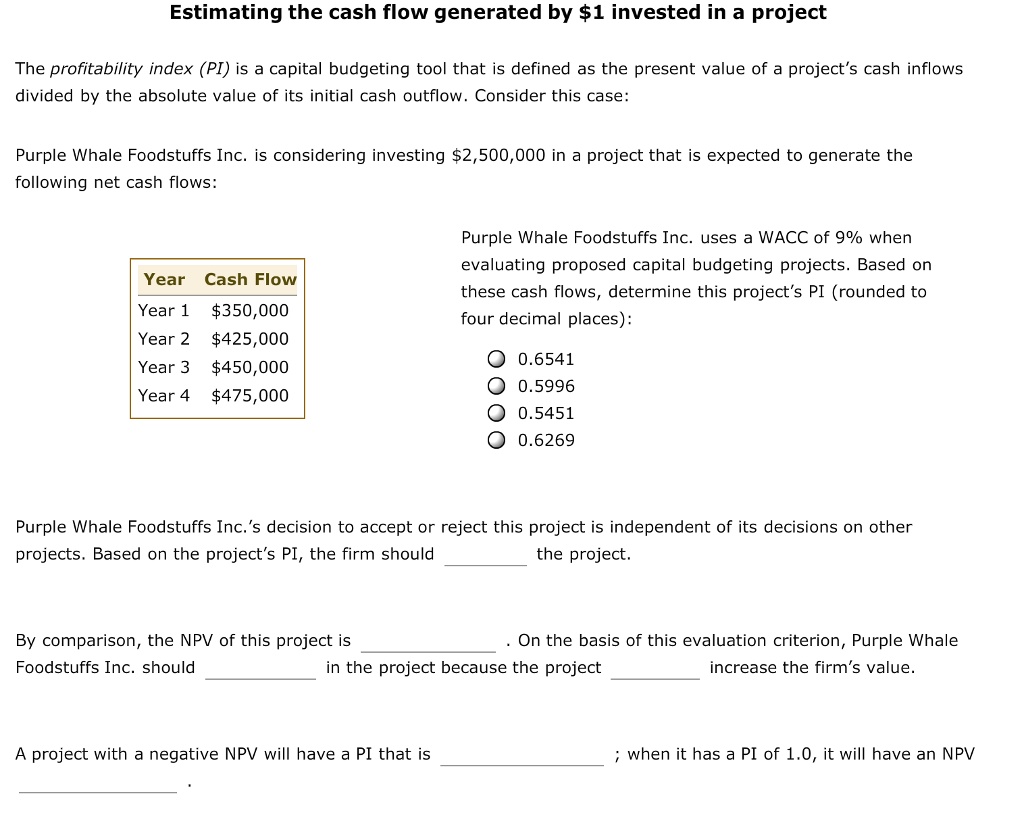

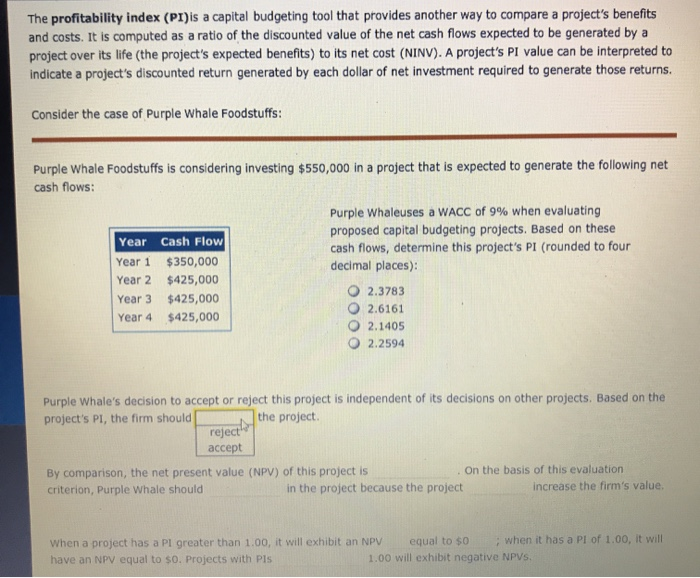

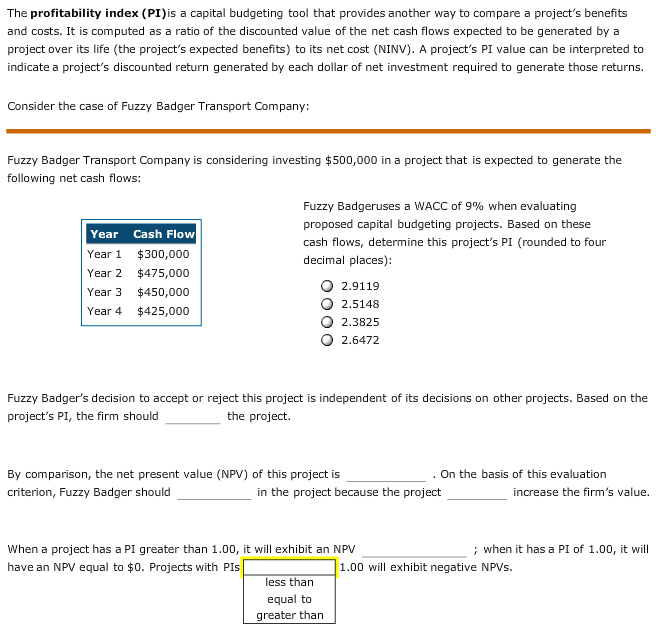

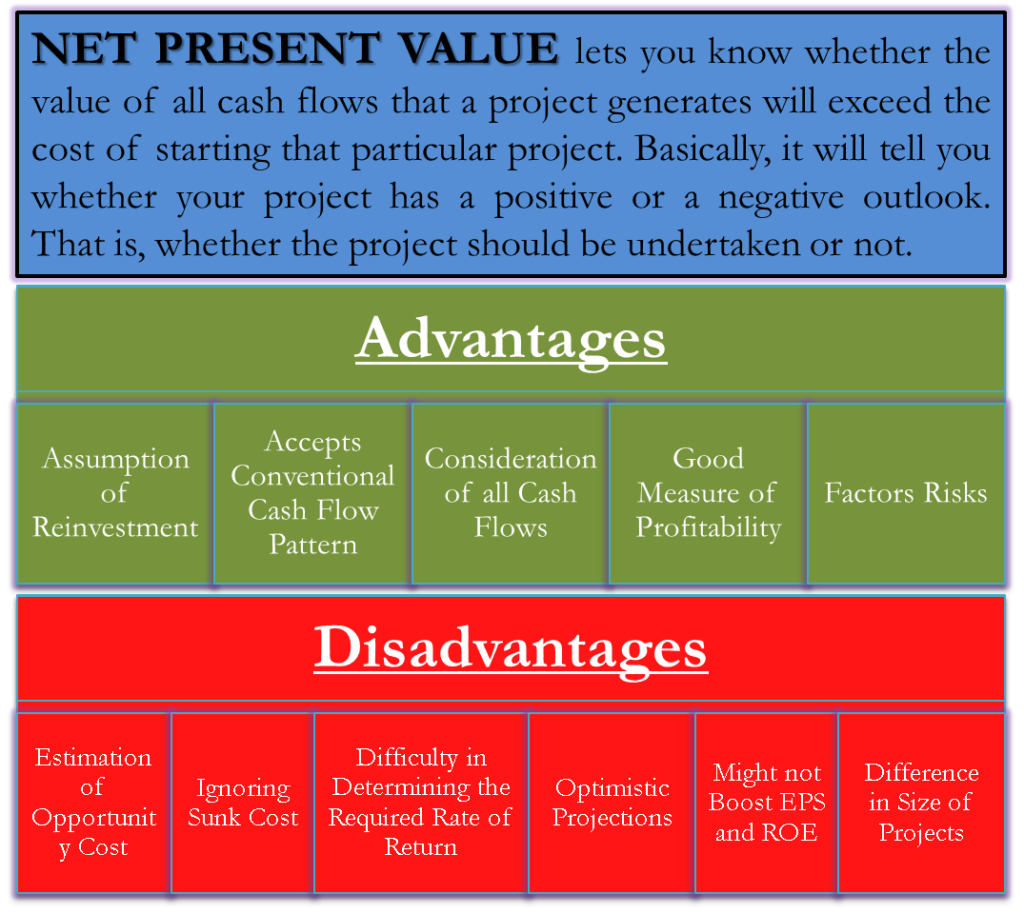

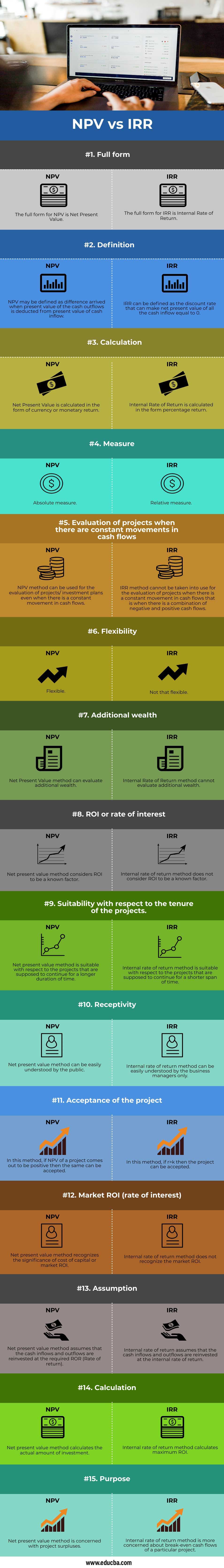

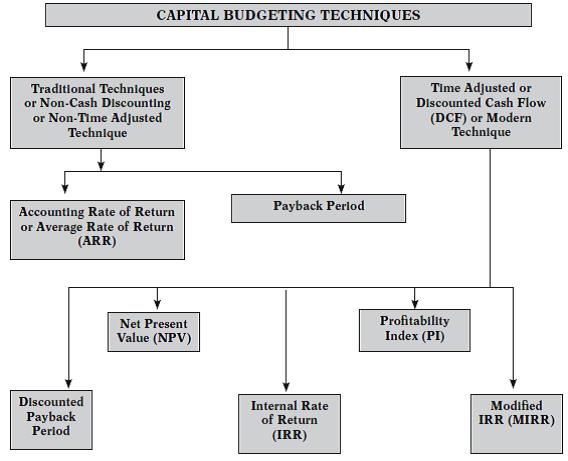

SOLVED: 4. Comparison of alternative decision criteria Aa Aa There are four principal decision models for evaluating and selecting investment projects: : Net present value (NPV) : Profitability index (PI) : Internal

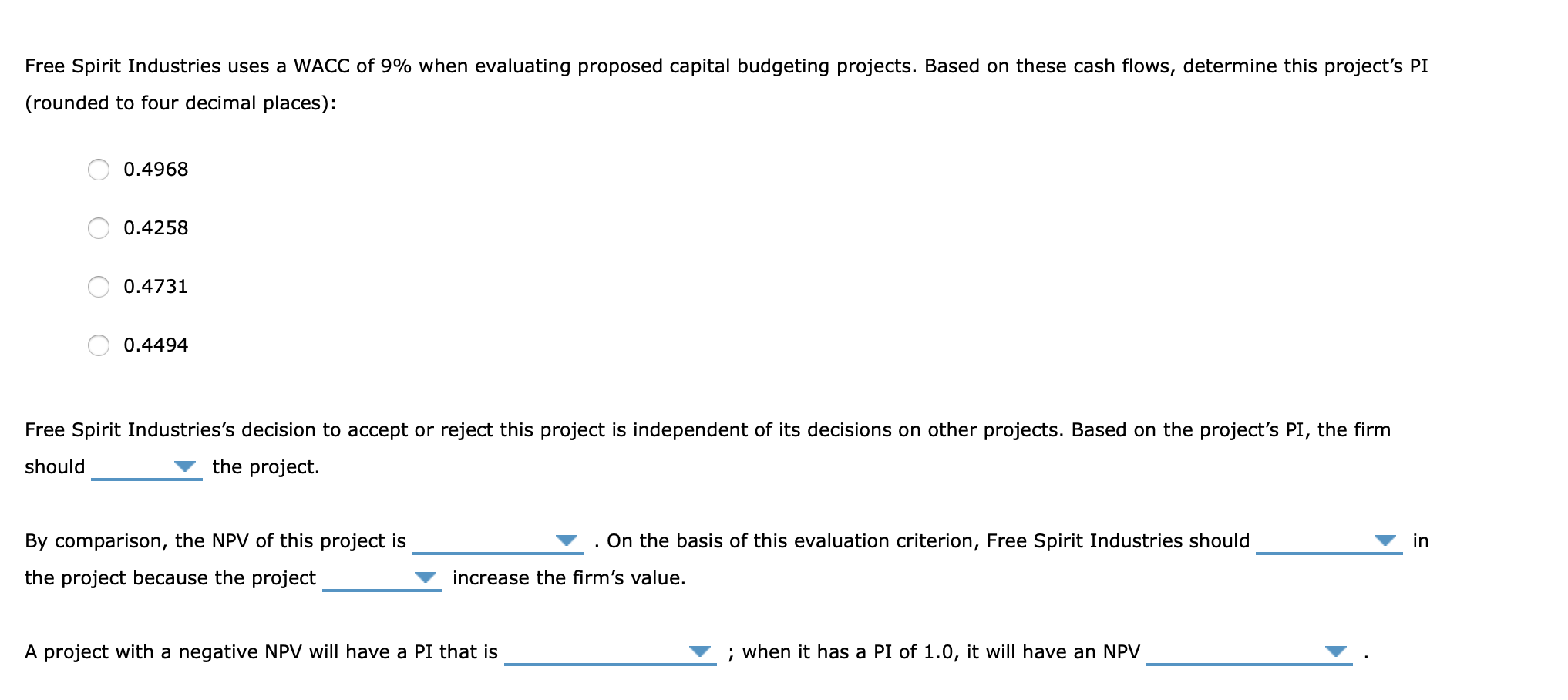

SOLVED: Please answer the following. If correct, I will make sure to thumbs up. Thank you! 1o. comparison of alternative decision criteria Aa Aa There are four principal decision models for evaluating

:max_bytes(150000):strip_icc()/NPVFormula-5c23ea8f46e0fb00013d2624.jpg)

:max_bytes(150000):strip_icc()/dotdash_final_Profitability_Index_Oct_2020-011-3cc06137c4e24b7dbef3515c7d989bd3.jpg)